Featured

Table of Contents

Keeping all of these phrases and insurance policy types directly can be a frustration. The adhering to table puts them side-by-side so you can promptly set apart amongst them if you get puzzled. An additional insurance policy coverage kind that can repay your home loan if you die is a common life insurance coverage policy

A is in area for a set number of years, such as 10, 20 or 30 years, and pays your beneficiaries if you were to pass away throughout that term. A gives insurance coverage for your entire life period and pays out when you pass away.

One common rule of thumb is to go for a life insurance policy plan that will certainly pay as much as 10 times the insurance policy holder's salary amount. Additionally, you might pick to utilize something like the penny technique, which includes a household's financial debt, income, home mortgage and education and learning expenses to determine just how much life insurance policy is required (home loan credit life insurance).

It's likewise worth noting that there are age-related restrictions and thresholds imposed by almost all insurers, who typically won't offer older buyers as numerous options, will bill them extra or may refute them outright.

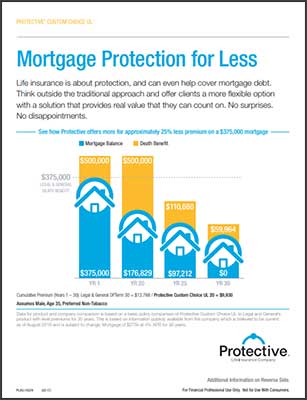

Below's just how home loan protection insurance policy determines up against standard life insurance. If you're able to certify for term life insurance, you must prevent home loan defense insurance (MPI).

In those circumstances, MPI can supply excellent peace of mind. Simply be sure to comparison-shop and read every one of the small print before authorizing up for any type of policy. Every mortgage protection alternative will have many rules, laws, advantage alternatives and drawbacks that need to be evaluated carefully against your specific scenario (our secure family mortgage insurance).

Best Mortgage Protection Cover

A life insurance policy policy can aid repay your home's mortgage if you were to die. It is among numerous methods that life insurance policy may aid secure your liked ones and their monetary future. Among the most effective ways to factor your mortgage right into your life insurance policy requirement is to speak with your insurance policy agent.

Instead of a one-size-fits-all life insurance policy plan, American Household Life Insurer provides plans that can be made particularly to satisfy your household's needs. Below are some of your choices: A term life insurance coverage plan. mortgage insurance is it worth it is active for a particular amount of time and normally uses a bigger quantity of protection at a lower price than a permanent policy

A entire life insurance coverage policy is just what it seems like. As opposed to just covering a set variety of years, it can cover you for your entire life. It likewise has living advantages, such as cash money value build-up. * American Household Life Insurance policy Firm offers various life insurance policy policies. Talk with your representative concerning tailoring a plan or a combination of plans today and getting the comfort you should have.

Your agent is a wonderful resource to answer your concerns. They might additionally be able to aid you locate voids in your life insurance protection or brand-new ways to conserve on your other insurance coverage plans. ***Yes. A life insurance policy beneficiary can pick to utilize the death advantage for anything - mortgage life insurance quotes uk. It's a great method to help secure the monetary future of your family if you were to die.

Life insurance policy is one method of aiding your household in paying off a home loan if you were to die prior to the home mortgage is completely repaid. No. Life insurance coverage is not obligatory, but it can be a vital part of helping ensure your loved ones are monetarily secured. Life insurance policy earnings may be utilized to assist pay off a home mortgage, however it is not the very same as home loan insurance policy that you could be needed to have as a problem of a funding.

Term Life Insurance For Mortgage Protection

Life insurance coverage may assist guarantee your home stays in your household by giving a death advantage that might help pay down a home loan or make important purchases if you were to pass away. This is a brief summary of protection and is subject to plan and/or cyclist terms and problems, which might vary by state.

The words life time, long-lasting and irreversible go through policy conditions. * Any type of finances taken from your life insurance policy plan will accumulate rate of interest. mortgage life cover. Any kind of impressive car loan equilibrium (financing plus interest) will certainly be deducted from the survivor benefit at the time of case or from the cash money value at the time of abandonment

Price cuts do not use to the life policy. Policy Types: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

Mortgage protection insurance policy (MPI) is a various kind of safeguard that can be handy if you're not able to repay your home loan. Mortgage defense insurance coverage is an insurance coverage plan that pays off the remainder of your home loan if you pass away or if you come to be handicapped and can't function.

Both PMI and MIP are called for insurance protections. The quantity you'll pay for home loan protection insurance depends on a range of variables, consisting of the insurer and the existing balance of your mortgage.

Still, there are benefits and drawbacks: Most MPI policies are provided on a "assured acceptance" basis. That can be helpful if you have a health problem and pay high rates permanently insurance policy or battle to acquire protection. mortgage protection and critical illness cover. An MPI plan can offer you and your household with a sense of protection

Mortgage Life Insurance Rate

You can pick whether you require home mortgage defense insurance coverage and for just how lengthy you need it. You could want your mortgage defense insurance policy term to be close in length to how long you have left to pay off your mortgage You can terminate a home loan security insurance coverage plan.

Latest Posts

Funeral Plans Compare The Market

Best Funeral Plan Company

Instant Life Insurance Quote Online