Featured

Table of Contents

That usually makes them a much more inexpensive alternative permanently insurance coverage. Some term plans might not maintain the premium and fatality profit the exact same over time. Level term life insurance. You do not want to incorrectly believe you're buying degree term protection and then have your death benefit modification in the future. Lots of individuals obtain life insurance policy coverage to aid financially shield their liked ones in instance of their unexpected death.

Or you may have the option to transform your existing term coverage into a long-term policy that lasts the remainder of your life. Different life insurance policies have possible advantages and disadvantages, so it is very important to understand each before you choose to purchase a plan. There are a number of benefits of term life insurance policy, making it a preferred choice for coverage.

As long as you pay the premium, your recipients will receive the fatality advantage if you die while covered. That claimed, it's essential to keep in mind that most plans are contestable for 2 years which indicates coverage can be retracted on fatality, should a misstatement be found in the application. Plans that are not contestable usually have actually a graded death benefit.

Why What Is Level Term Life Insurance Is an Essential Choice?

Costs are usually lower than entire life plans. With a degree term policy, you can pick your protection amount and the plan size. You're not locked into a contract for the remainder of your life. Throughout your plan, you never ever have to fret about the premium or death benefit quantities altering.

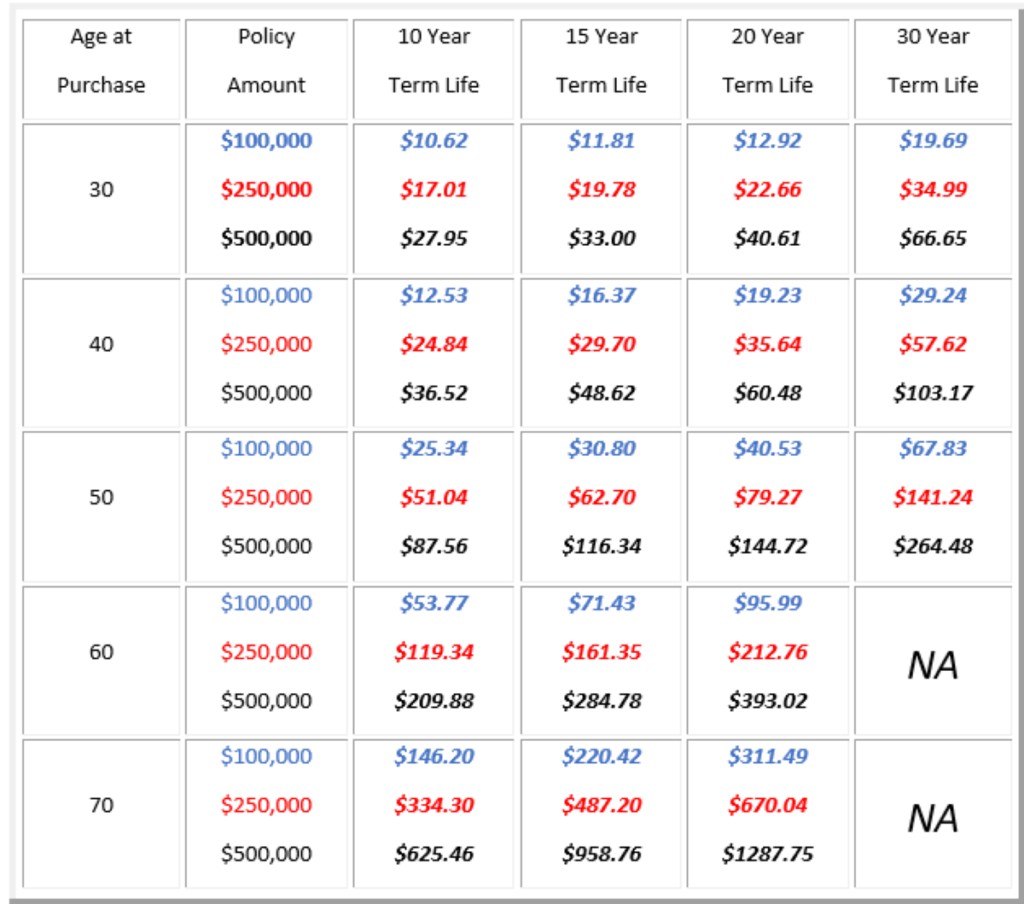

And you can't squander your policy throughout its term, so you will not receive any monetary take advantage of your past coverage. As with other sorts of life insurance policy, the price of a level term plan relies on your age, coverage demands, work, lifestyle and health and wellness. Generally, you'll discover much more budget friendly insurance coverage if you're more youthful, healthier and much less dangerous to insure.

Considering that level term premiums remain the very same throughout of insurance coverage, you'll understand exactly just how much you'll pay each time. That can be a huge aid when budgeting your expenses. Degree term coverage also has some flexibility, permitting you to customize your policy with extra functions. These often been available in the type of cyclists.

What is Term Life Insurance With Level Premiums Coverage?

You might have to fulfill particular problems and credentials for your insurer to pass this cyclist. There likewise might be an age or time restriction on the coverage.

The survivor benefit is commonly smaller sized, and insurance coverage typically lasts till your child transforms 18 or 25. This cyclist may be an extra cost-effective way to aid ensure your kids are covered as cyclists can often cover several dependents simultaneously. As soon as your youngster ages out of this protection, it might be feasible to convert the rider right into a new policy.

The most usual type of permanent life insurance coverage is entire life insurance, yet it has some key differences compared to level term protection. Below's a fundamental introduction of what to consider when comparing term vs.

What is Term Life Insurance? Your Essential Questions Answered?

Whole life entire lasts insurance coverage life, while term coverage lasts for a specific periodParticular The costs for term life insurance coverage are commonly reduced than whole life coverage.

One of the major features of level term insurance coverage is that your premiums and your fatality benefit don't transform. You may have coverage that starts with a fatality advantage of $10,000, which could cover a home loan, and after that each year, the death benefit will certainly decrease by a collection amount or portion.

Because of this, it's usually a much more inexpensive kind of degree term protection. You may have life insurance policy with your company, but it might not suffice life insurance for your demands. The primary step when getting a plan is identifying just how much life insurance policy you need. Take into consideration elements such as: Age Household dimension and ages Work standing Earnings Financial debt Lifestyle Expected last expenditures A life insurance policy calculator can aid determine just how much you need to begin.

What is 10-year Level Term Life Insurance Coverage?

After selecting a plan, complete the application. For the underwriting process, you might have to provide general personal, health and wellness, lifestyle and work info. Your insurer will identify if you are insurable and the danger you might present to them, which is shown in your premium costs. If you're accepted, authorize the paperwork and pay your first premium.

Finally, take into consideration scheduling time annually to examine your plan. You might intend to upgrade your beneficiary information if you've had any type of considerable life changes, such as a marriage, birth or separation. Life insurance coverage can often feel complicated. You do not have to go it alone. As you discover your options, take into consideration discussing your demands, desires and worries about a financial expert.

No, degree term life insurance policy doesn't have cash value. Some life insurance coverage policies have a financial investment function that permits you to build money worth over time. A part of your premium repayments is reserved and can gain rate of interest with time, which grows tax-deferred during the life of your coverage.

You have some options if you still want some life insurance policy coverage. You can: If you're 65 and your insurance coverage has actually run out, for instance, you might desire to buy a brand-new 10-year level term life insurance policy.

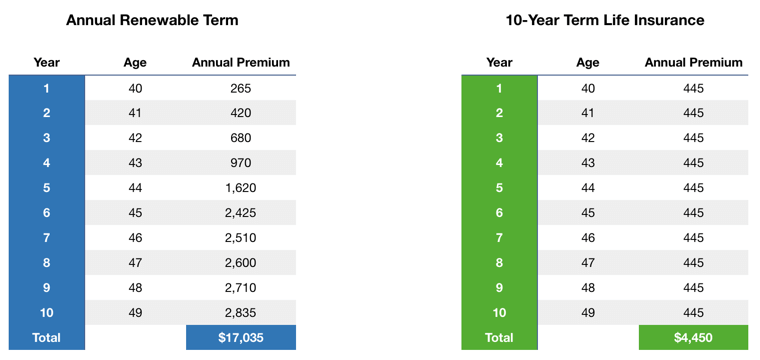

The Benefits of Choosing Annual Renewable Term Life Insurance

You may be able to transform your term coverage right into an entire life policy that will last for the rest of your life. Lots of kinds of level term policies are convertible. That implies, at the end of your protection, you can transform some or all of your policy to whole life insurance coverage.

A degree costs term life insurance policy plan allows you stay with your budget plan while you aid shield your family members. Unlike some tipped price plans that raises each year with your age, this type of term strategy offers rates that stay the same through you select, even as you grow older or your health and wellness adjustments.

Discover more regarding the Life insurance policy alternatives readily available to you as an AICPA participant (Level premium term life insurance policies). ___ Aon Insurance Policy Solutions is the brand name for the brokerage and program management procedures of Affinity Insurance policy Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Policy Agency, Inc. (CA 0795465); in OK, AIS Fondness Insurance Policy Solutions Inc.; in CA, Aon Fondness Insurance Coverage Solutions, Inc .

Latest Posts

Funeral Plans Compare The Market

Best Funeral Plan Company

Instant Life Insurance Quote Online